Last week, we brought you Debt Collection Faux Pas on Social Media to show you what it looks like when debtors complain about bad collections on social platforms. However, bad collections don’t always result in public online complaints. Sometimes, bad collections can have the opposite effect – public gloating. In fact, debtors who take advantage of disorganized collections are now bragging about it on social media. Below are three ways that debtors are using social media to gloat about giving collection agencies the runaround:

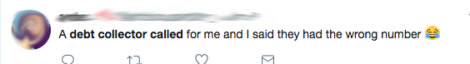

- Side Step the Collector

Collectors who aren’t using a streamlined collections system can easily lose track of the correct contact information for debtors. In today’s world, people usually have several telephone lines, including mobile phones. Without a system to keep track of all phone numbers and any changes to contact information, it becomes much easier for debtors to simply sidestep paying their debts. Instead, they simply send the collector on a wild goose chase to find the most accurate phone number. Without all the information a collector needs in front of them, clearing up confusion about contact information can cause significant delays in collection.

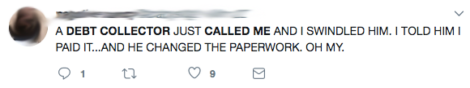

2. Cause Payment Confusion

In the tweet below, the debtor brags about swindling the debt collector by lying about having paid a debt. While this might seem impossible to pull off in 2017, agencies and businesses who are still working off stacks of paper, spreadsheets, archaic systems leave themselves open to these kinds of errors. You may not believe this still happens in 2017, but check out this article in the New York Times describing loans worth as much as $5 Billion which have gone missing, simply as a result of lost paperwork.

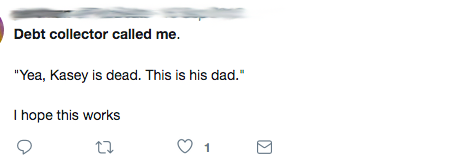

3. Take Advantage of Poor Note Taking

When there’s no relationship being recorded and maintained throughout the collection process, it’s easy to tell egregious lies about being dead. Without a way to keep track of prior conversations and interactions, debt collectors become more susceptible to lies, and have to spend much more time trying to verify or disprove false claims made by debtors.

TALK TO US: How much time does your agency spend chasing down accurate information? If you’re looking for a platform that keeps all the data and records you need on screen, get the free trial of D2R-Collect here .

Don’t forget to connect with us on Twitter, Facebook, LinkedIn & Instagram!