Every aspect of our lives has adversely been affected by the COVID-19 pandemic. Businesses are struggling and revenue is dwindling as a result of reduced activity. Creditors have to be shrewd and ingenious to collect their dues from debtors.

Various governments have come up with stimulus measures to cushion their countries from an economic crisis. While this only serves to temporarily alleviate the financial distress faced, it doesn’t deal with the debt pressure incurred by the business. Many businesses will strain to keep afloat and continue to battle this financial depression.

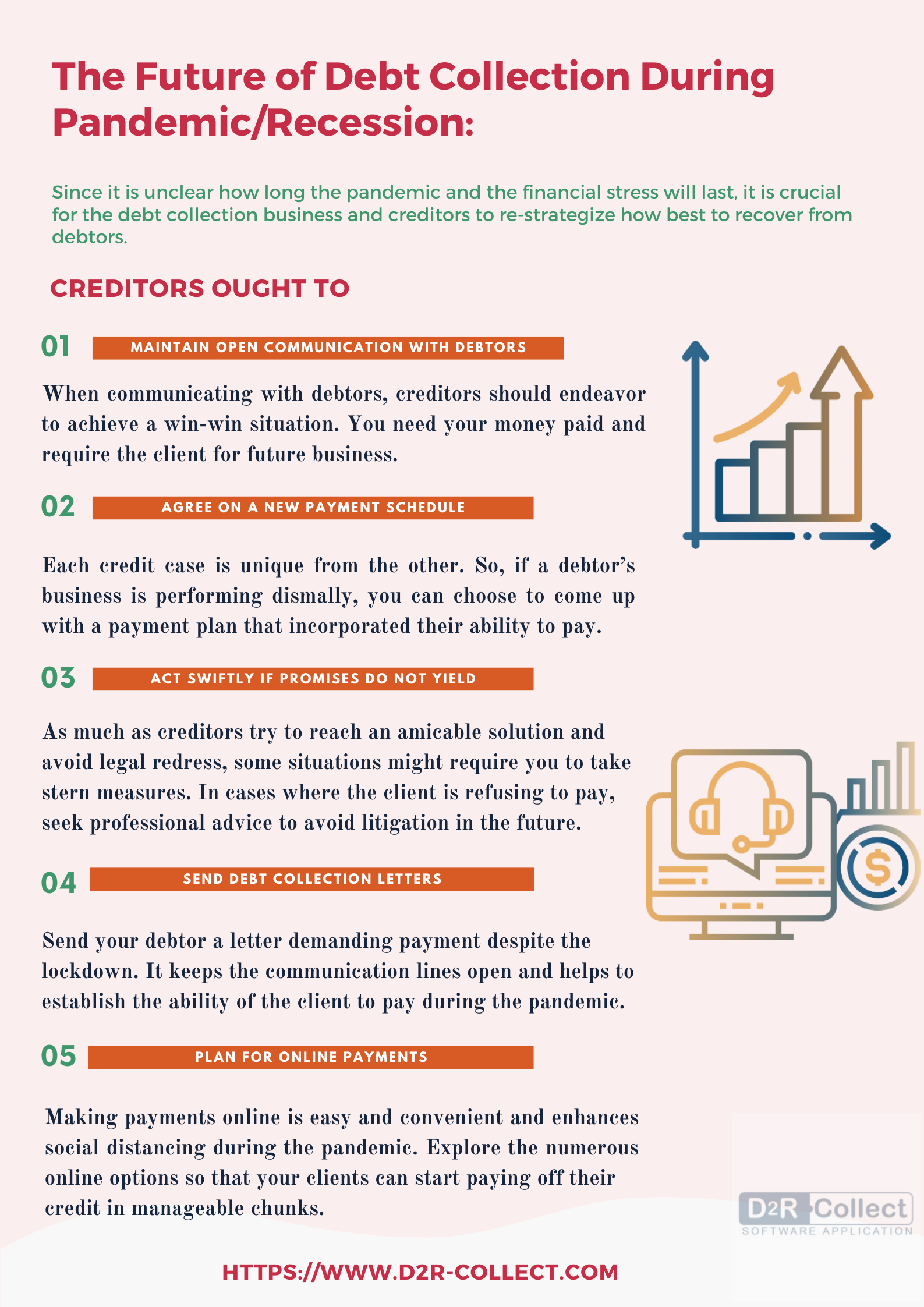

Since it is unclear how long the pandemic and financial stress will last, it is crucial for the debt collection business and creditors to re-strategize the recovery of debt from their debtors.

Creditors Ought To

1. Maintain open communication with debtors

When communicating with debtors, creditors should endeavor to achieve a win-win situation. You need your money paid and require the client for future business. You ought to treat the client with the utmost respect owing to the pressure associated with the pandemic.

While contacting your creditors, avoid alarming your client with threats and aggression. Communication will help you establish which debtor is adamant about paying and who is in genuine financial distress.

2. Agree on a new payment schedule

Each credit case is unique from the other, if a debtor’s business is performing dismally, you can choose to come up with a payment plan that incorporates their ability to pay. For instance, you can prolong the credit term and offer them more time to repay their debts. Such a strategy ensures you do not lose your money while ensuring the debtors satisfaction.

3. Act swiftly if promises do not yield

As much as creditors try to reach an amicable solution and avoid legal redress, some situations might require you to take stern measures. In cases where the client is refusing to pay, seek professional advice to avoid litigation in the future. Apart from providing room for legal redress, this approach ensures repayment of debts in the event the debtor is declared insolvent.

4. Send debt collection letters

Send your debtor a letter demanding payment despite the lockdown. It keeps the communication lines open and helps to establish the ability of the client to pay during the pandemic.

5. Plan for online payments

Making payments online is easy and convenient and enhances social distancing during the pandemic. Explore the numerous online options so that your clients can start paying off their credit in manageable chunks.

Conclusion

As more people work from home due to the pandemic, debt collection has become a little more complicated. However, debt collectors can use clients’ reports available online to determine delinquent clients and make the decision to acquire the legal documentation to protect their business.

Sharing is caring!